Consider…

DO YOU PRESENTLY EMPLOY FINANCE RESOURCES, SUCH AS AN INTERNAL ACCOUNTANT, BOOKKEEPER OR MORE?

Are you spending significant resources on WAGES, TRAINING, RETENTION training staff?

ARE YOU RECEIVING TIMELY AND ACCURATE INFORMATION TO MAKE BETTER BUSINESS DECISIONS?

Comprehensive range of services

COST-EFFECTIVE, ADAPTABLE & INSIGHTS-DRIVEN

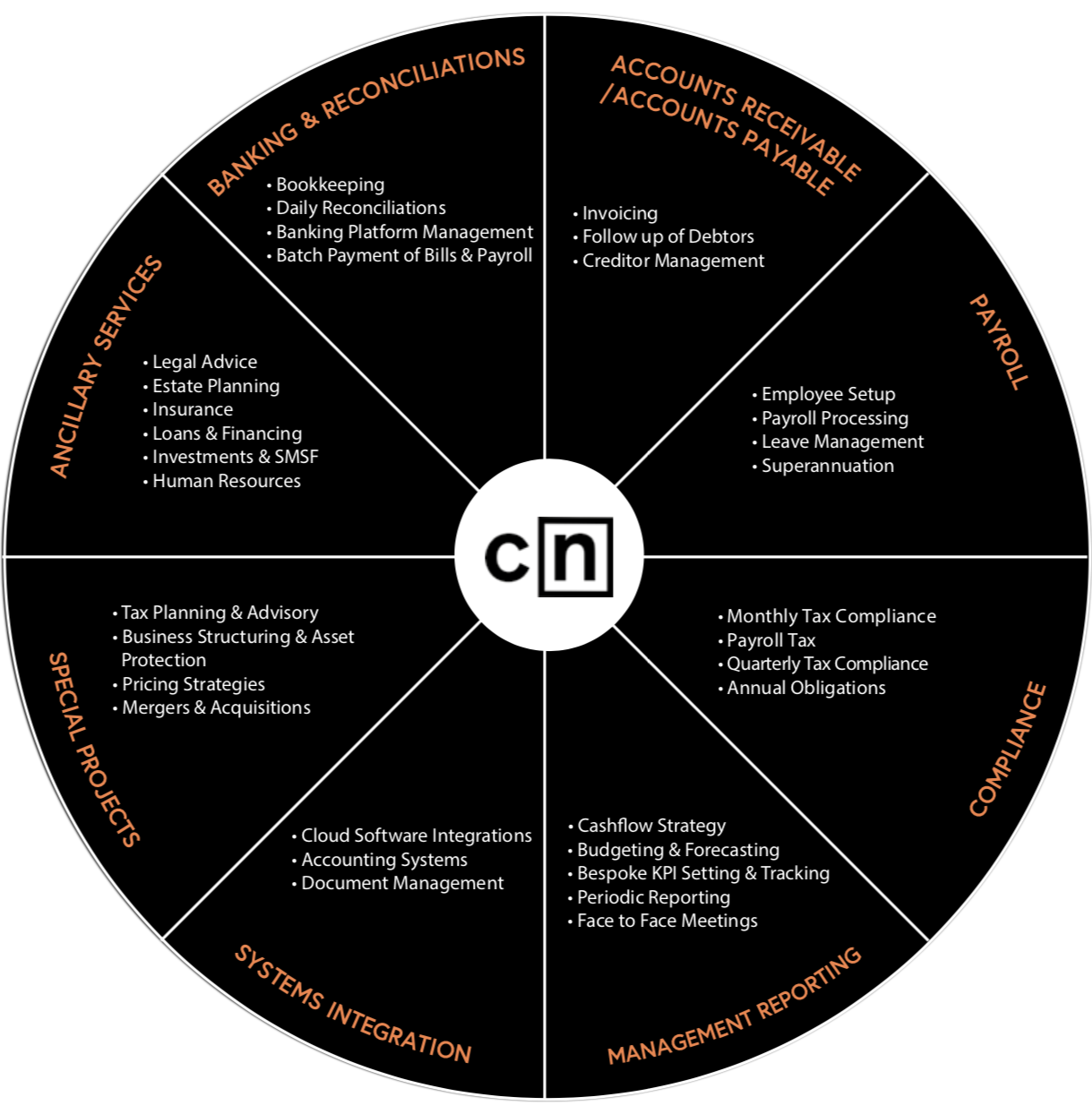

CharterNet Rothsay Finance Function provides a comprehensive range of services for businesses looking for a scalable and integrated solution across finance requirements, CFO and special project services. The bespoke solution gives businesses access to experienced professionals and resources without the burden of hiring insourced finance teams – a new way forward for SMEs looking to save time, reduce costs, and maximise value.

The model assumes responsibility for the full suite of finance function responsibilities from the grassroots (bank, creditors, payroll) through to tactical (budgeting, forecasting, monthly reporting vs KPIs and set budgets) to the high level strategic (corporate governance, board reporting, debt and equity funding, M&A). Outsourcing the finance function offers a breadth and depth of expertise beyond what is typically accessible or affordable for a SME.

at CharterNet Rothsay

our team holds experience from Big Four & mid-tier firms across Australia.

OUR END-TO-END SOLUTION

Ancillary Services

- Legal Advice

- Estate Planning

- Insurance

- Loans & Financing

- Investments & SMSF

- Human Resources

Banking and Reconciliations

- Daily Reconciliations

- Banking Platform Management

- Bookkeeping

- Batch Payment of Bills & Payroll

Accounts Receivable / Accounts Payable

- Invoicing

- Follow up of Debtors

- Creditor Management

Special Projects

- Tax Planning & Advisory

- Business Structuring & Asset Protection

- Pricing Strategies

- Mergers & Acquisitions

Payroll

- Employee Setup

- Payroll Processing

- Leave Management

- Superannuation

Systems Integrations

- Accounting Systems

- Document Management

- Cloud Software Integrations

Management Reporting

- Cashflow Strategy

- Budgeting & Forecasting

- Periodic Reporting

- Bespoke KPI Setting & Tracking

- Face to Face Meetings

Compliance

- Monthly Tax Compliance

- Payroll Tax

- Quarterly Tax Compliance

- Annual Obligations

How we deliver

The availability of cloud-based technology and tools allow seamless and transparent work on the company’s books and records in order to realise major time savings through automated process flows. While technology enables our team to work remotely, the ability to foster engagement via regular touch points (calls, meetings, guaranteed turnaround times on reporting and/or fixed time on-site) is still critical to effectiveness of the CFF model.

In an era where customer experience trumps price and product, a finance function solution is required which suits the needs of each individual business. The service suite, deliverables, touch points, engagement teams and any other delivery variables are treated as “modular” and can be added/removed or changed to the needs of each client.

Our humanistic and high-touch ethos underpins the service. Through a “continuous engagement” model that maximises touch points, the CFF is delivered based on client care and trust, allowing us to immerse ourselves in clients’ businesses, significantly reduce costs, and truly add value.

seamless + transparent tools

enabling efficient work through cloud-based technology

Contact Us

BENEFITS OF WORKING WITH US

FOCUS

Free up resources to focus on what matters

CLARITY

Timely reporting on business performance. Advisers that speak your language

SIMPLICITY

Peace of mind with a full outsourced finance function

AVOID MISSED DEADLINES

Guaranteed turn around times

SCALABLE SERVICES

Ability to grow with your business

FIXED FEES

No surprises

REDUCE COST

Compared to using internal resources

TAILORED TO YOU

Meeting outside business hours and on weekends